Healthy Dividends: Organic Growth Points North For West Pharmaceutical Services (WST)

[ad_1]

Anna Tretiak/iStock via Getty Images

West Pharmaceutical Services “West” (NYSE:WST) has had a firm position in the Compounding Healthcare “Healthy Dividend” Portfolio for several years attributable to the company becoming a critical component of the healthcare industry. The position has strengthened thanks to the ticker becoming a Dividend Aristocrat. Recently, West has been a key player in the battle against COVID-19 by manufacturing packaging components and delivery systems to support vaccines and diagnostic kits. West is a leader in the development and manufacturing of vials, cartridges, and storage components that are used for injectibles around the world. As result, the company has experienced a surge in business, and the share price has followed suit. However, West has several opportunities for organic growth that will help them maintain growth beyond COVID-19. For that reason, I am looking to move WST higher up on the Healthy Dividends totem pole and start allocating a great percentage of my trading profits to this Dividend Aristocrat.

I intend to provide a brief background on West Pharmaceutical Services and will discuss their recent performance. In addition, I will highlight some of the company‘s growth opportunities. Finally, I discuss my plan for adding to my WST position after this intense sell-off.

Company Overview

West Pharmaceutical Services is a leading global manufacturer in the design and production of integrated containment and delivery systems for injectable medicines. West Pharmaceutical Services is competitive thanks to the company‘s reputation for excellence and consistency in engineering, as well as the company‘s compliance with regulatory requirements. West has specialized knowledge of container closure systems, which improves developing delivery systems. This is evident in the company‘s portfolio of proprietary technologies for drug delivery devices, pre-fillable syringes, auto-injectors, safety needles, and additional proprietary systems. The company is using novel technologies for their manufacturing of insert molding, multi-shot precision molding, and multiple-piece closure systems. Furthermore, West has a global manufacturing capability with the ability to produce these products at several sites.

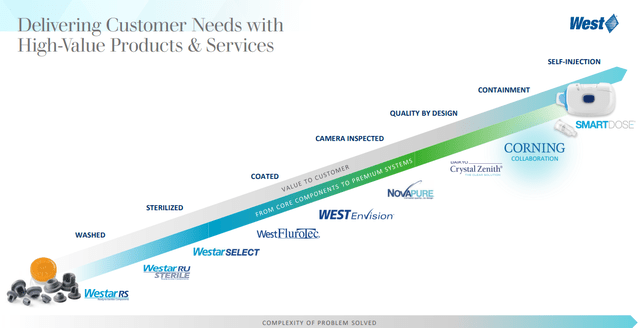

West Products and Services (West Pharmaceutical Services)

Furthermore, the company also offers services to provide pre-approval primary packaging support, lab services, regulatory expertise, and technical support.

Performance

2021 was an impressive year for West thanks to strong demand for the company‘s base business and accelerated demand for components for COVID-19 vaccines and therapeutics. The company closed out the year with a 28% increase in sales in Q4, which when “adjusted for COVID-related sales grew in the mid-teens organically.”

West Q4 Organic Sales Growth (West Pharmaceutical Services)

Additionally, the company‘s proprietary product segment experienced nearly 37% organic sales growth.

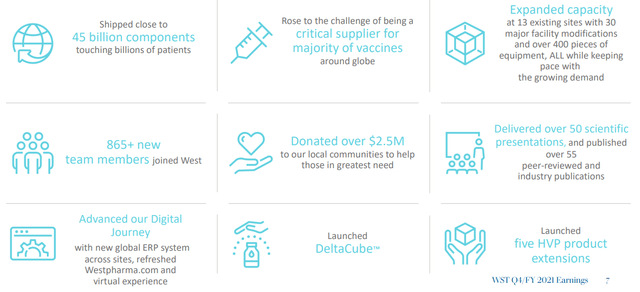

West 2021 Accomplishment (West Pharmaceutical Services)

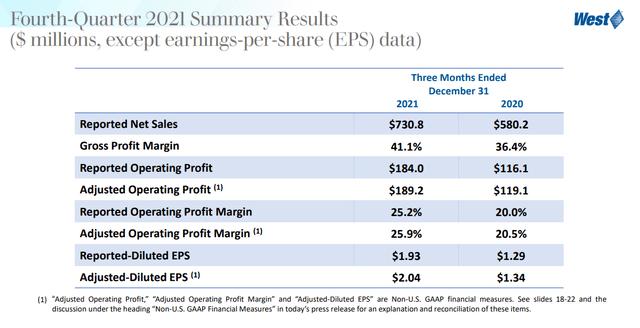

Looking at the company‘s Q4 2021 earnings summary results, we can see that this past year‘s performance is head and shoulders above 2020.

Q4 2021 Earnings Summary Results (West Pharmaceutical Services)

The company pulled in $2.832B in net revenue for 2021, which is up 31.9% over 2020. In addition, the adjusted diluted earnings per share were $8.58, up 80% over 2020. Furthermore, the company saw a 67.48% growth in EBITDA, which is well above 19.28%. In fact, WST outperforms the sector median in almost every growth category.

The same can be said about WST‘s profitability grades, where the company‘s net income margin is 23.37% to go along with a levered free cash flow margin coming in at 7.32%. West‘s return on equity came in at ~31.59%, and return on assets was at 19.97%.

Into the bargain, West shipped over 45B components, expanded their capacity, launched DeltaCube, and launched five HVP product extensions.

Considering the points above, one cannot deny that the company is at full throttle and is running on all cylinders as we move deeper into 2022.

Still Expecting Growth

Looking ahead, the company appears to have a growth strategy that focuses on globalization of the company‘s operations as well as continued capital investments to fuel development.

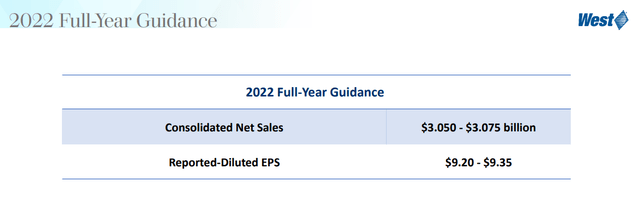

For the near term, the company‘s committed order book is at an all-time high. Obviously, it is hard to see where COVID-19 sales will be in a couple of years; however, there is no doubt that the company is still going to significant revenue in the near term. In fact, the company expects their 2022 net sales to be in the range of $3.05B to $3.075B with EPS coming in between $9.20 and $9.35.

2022 Full-Year Guidance (West Pharmaceutical Services)

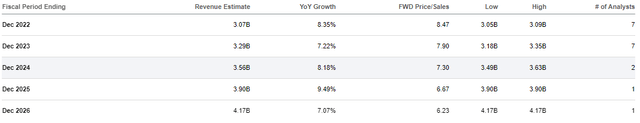

In fact, the Street expects West to report steady revenue growth for the next several years.

Analyst Annual Revenue Estimates (Seeking Alpha)

Obviously, this will translate into EPS growth, where Street analysts expect the company to go from $9.26 in 2022 to $14.22 in 2026.

Analyst Annual EPS Estimates (Seeking Alpha)

Clearly, West and the Street are expecting the company‘s high-value products to continue to support organic growth along with strong contributions from biologics, generics, pharmaceuticals, and contracting manufacturing… with or without COVID-19. Considering the company‘s reputation as a leader in their industry and their recent performance, I am willing to hang my hat on West‘s ability to hit these projections.

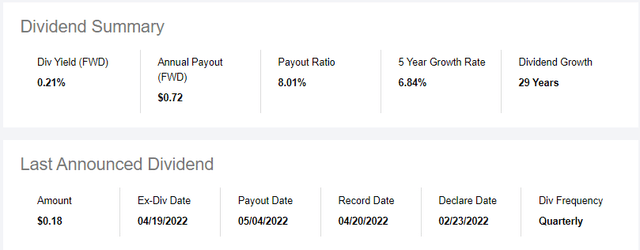

A Small But Healthy Dividend

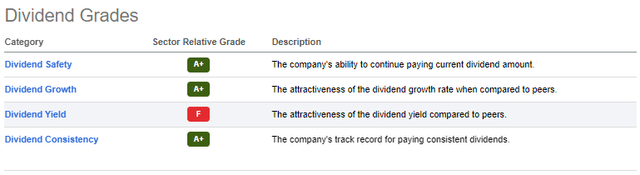

WST has a firm position in the Compounding Healthcare “Healthy Dividends” Portfolio due to its status as a Dividend Aristocrat, as well as the dividend‘s safety.

WST Dividend Grades (Seeking Alpha)

However, WST‘s dividend yield and the payouts are embarrassing. At the moment, WST‘s 4-year average yield is 0.35% and the 1-year yield on cost is 0.22%, which are abysmal compared to the sector median.

WST Dividend Summary (Seeking Alpha)

Additionally, WST‘s forward annual payout is $0.72 for 2022 and is expected to grow to $0.85 by 2024. So, we can say WST‘s dividend is not a focal point of the bull thesis. However, it is a healthy dividend that is safe and is expected to grow in the coming years, which isn‘t a negligible point for the bulls.

Risks

Despite my bullish sentiment, I must concede that there are a few risks that could derail the company‘s growth trajectory. First, there is the potential for a change in COVID-19 response that could alter headwinds and/or tailwinds. West has become a critical player in the COVID-19 response; however, we could see vaccination rates drop in the coming quarters as the population loses interest in getting multiple booster shots. Obviously, a steep drop in vaccinations could hurt West Pharmaceutical Services. On the other hand, a prolonged pandemic will continue to impact other healthcare procedures that utilize West‘s products. Either way, it is possible a change in the world‘s response to COVID-19 could have a significant impact on the company‘s growth trajectory in the coming years.

Another risk to consider is the company‘s competition. West competes with several companies across the globe for some of the company‘s products and services. The competition could find a way to outcompete West in product design, performance, quality, regulatory, and scientific expertise, together with total cost. The competition varies from smaller regional companies to large global manufacturers. Some of the company‘s competition includes Stevanato Group (STVN), Corning (GLW), Becton, Dickinson and Company (BDX), Cardinal Health (CAH), Teleflex (TFX), Nipro (OTC:NPRRF), Gerresheimer (OTC:GRRMF), and Nemera. Indeed, I cannot find any company that is a clear matchup for West; however, all of these companies could impact West‘s performance in their respective industries.

Perhaps the biggest near-term risk to WST is the ticker‘s current valuation… which is quite expensive considering it isn‘t expected to report explosive growth in the coming years, and the dividend isn‘t going to provide huge payouts for the foreseeable future. As result, investors need to accept the market is going to attempt to knock off some of the ticker‘s premium in the coming quarters in order to get the share price closer to a more realistic value.

My Plan

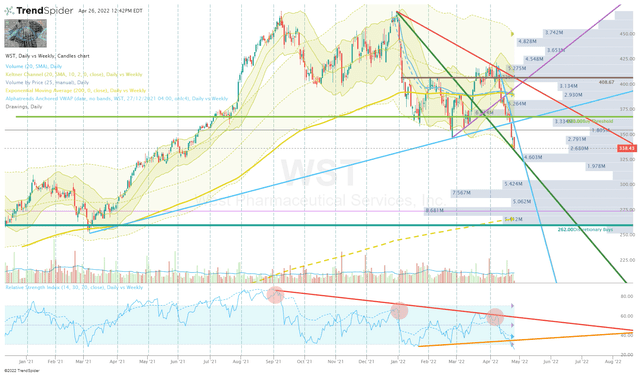

My general plan for WST is similar to my other Healthy Dividend names, which is to amass a large position over several years using a dollar-cost average “DCA” strategy. However, I will be a bit more selective with my additions considering the ticker being overvalued with a trivial dividend. Therefore, I’m going to institute a buy threshold that will help prevent blindly overpaying. This threshold is intended to be a guideline to make periodic investments as long as the share price is trading under my Multi-stage Dividend Discount Model “DDM” target of roughly $370 per share. I will also use a low sensitivity Discount Cash Flow “DCF” model to get a discount price of ~$262 per share, which is where I will increase my buy size.

At the moment, WST is trading well under my buy threshold, so I will be looking to click the buy button once I see a strong reversal setup. Sadly, the angle of attack is steep to the downside.

WST Daily Chart (TrendSpider)

So, I am going to wait for the dust to settle before clicking the buy button again anytime soon. However, I will set up a few buy orders around the $262 area just in case the company reports lackluster earnings or disappointing guidance updates in their upcoming Q1 report.

Long-term, I expect to keep WST in my Healthy Dividend Portfolio for at least five more years in anticipation the company continues to expand their business and report both earnings and dividend growth.

[ad_2]

Source link